Build above-average

capital growth without

spending hours googling

"best suburbs to invest"

Accelerate growth 2-4x with the Capital Growth Accelerator... skip the dud courses and property spruikers to finally get peace of mind that you’re getting real results.

CLICK BELOW TO WATCH FIRST!

NEXT STEP: complete the form below to start your application

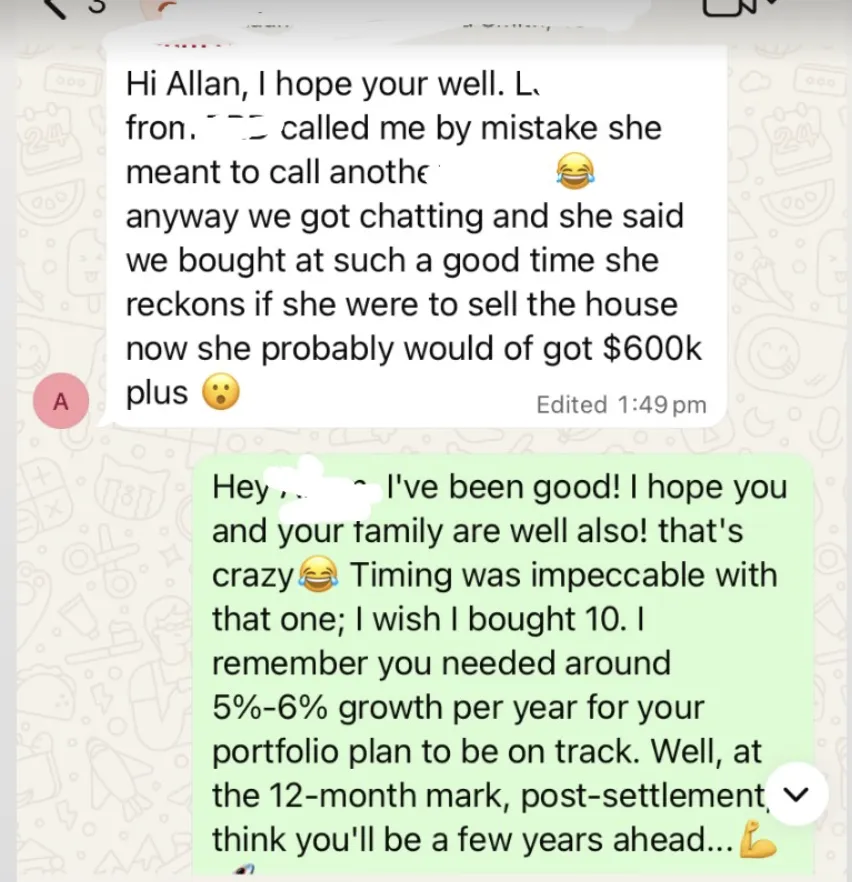

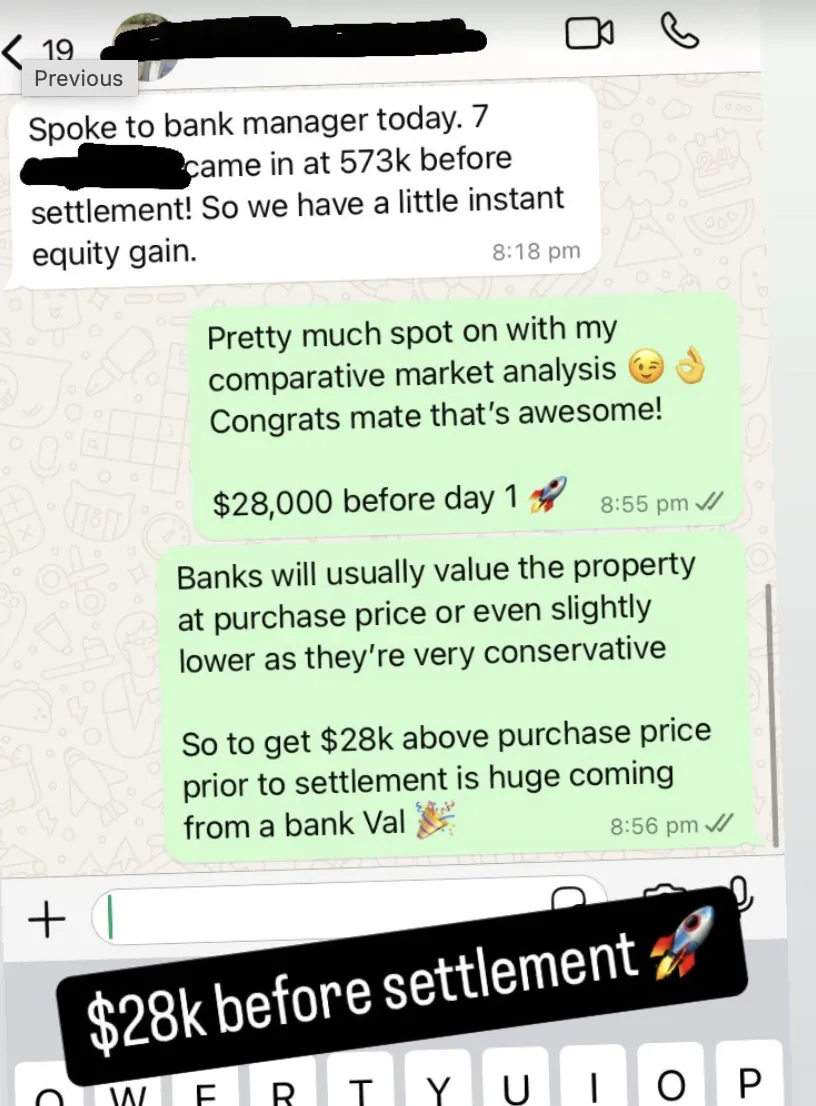

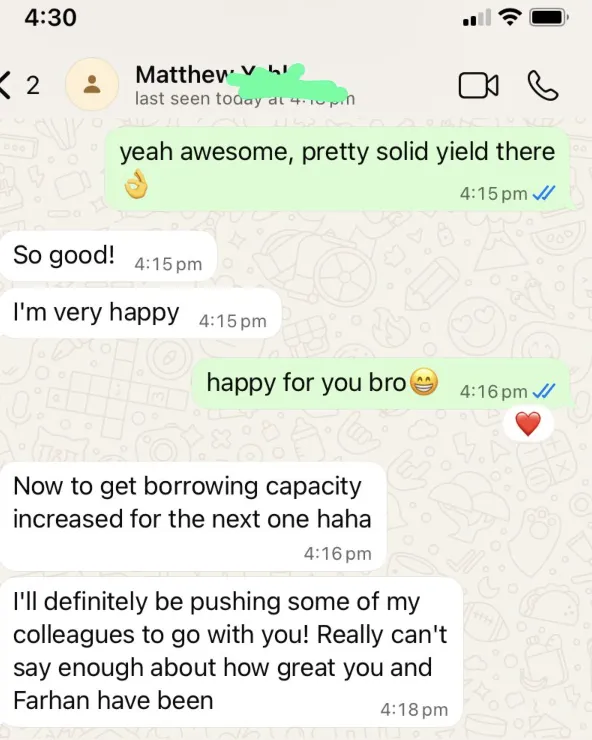

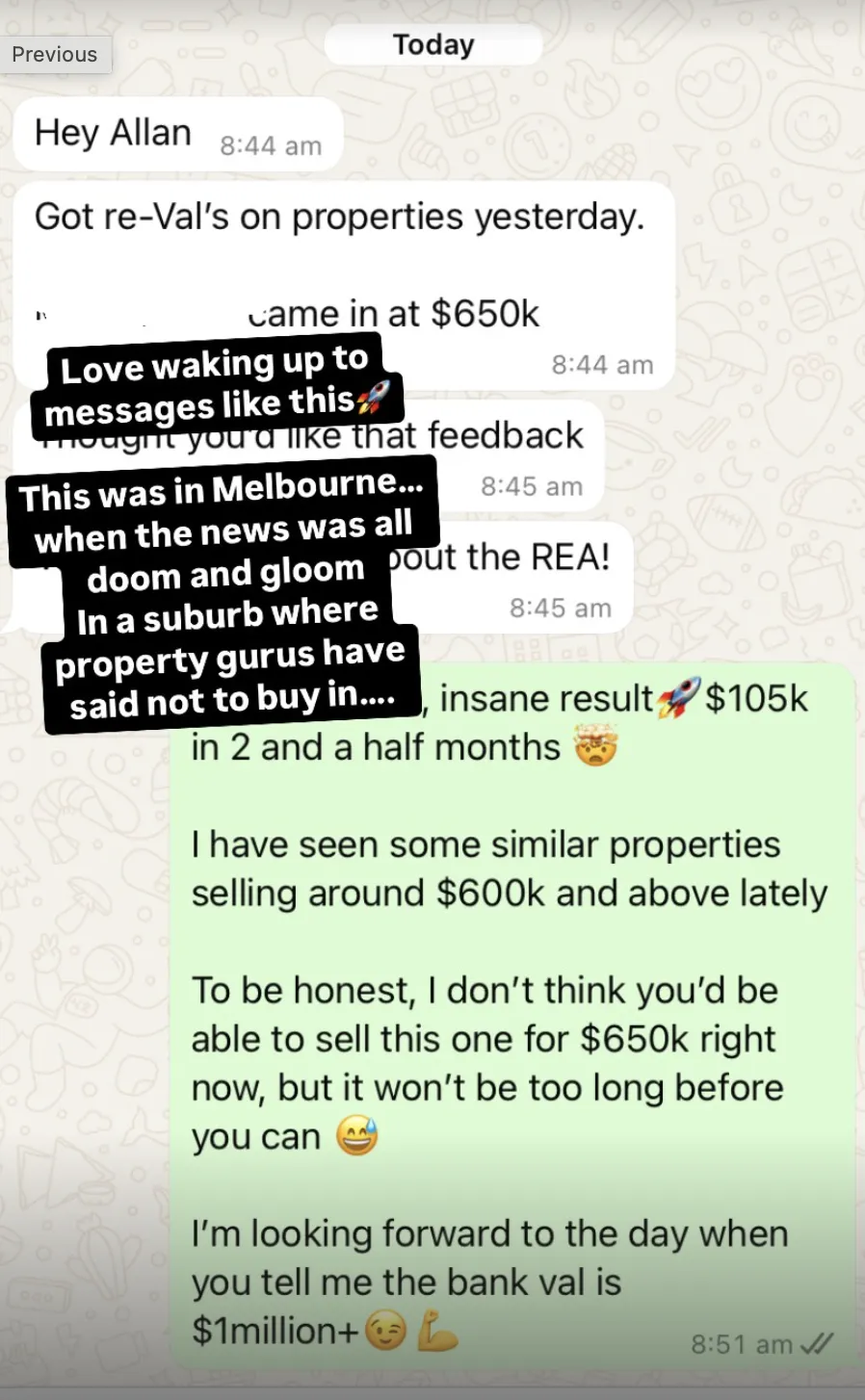

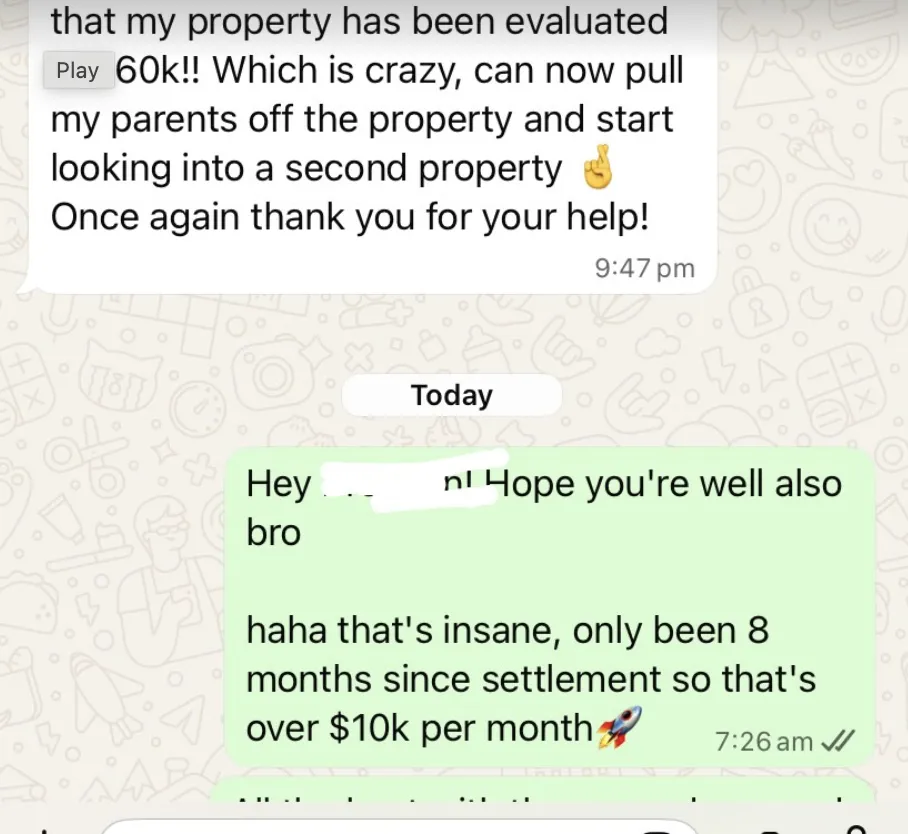

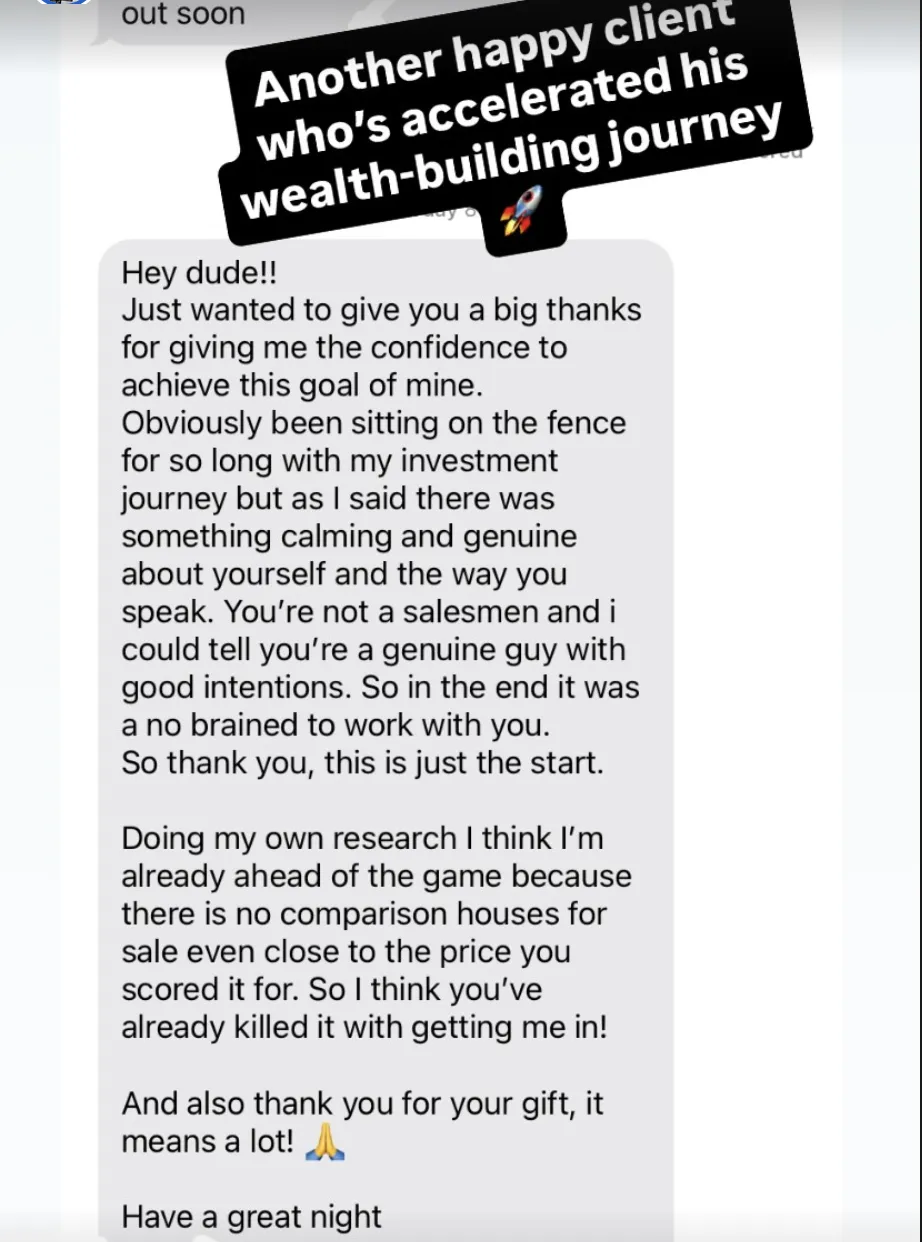

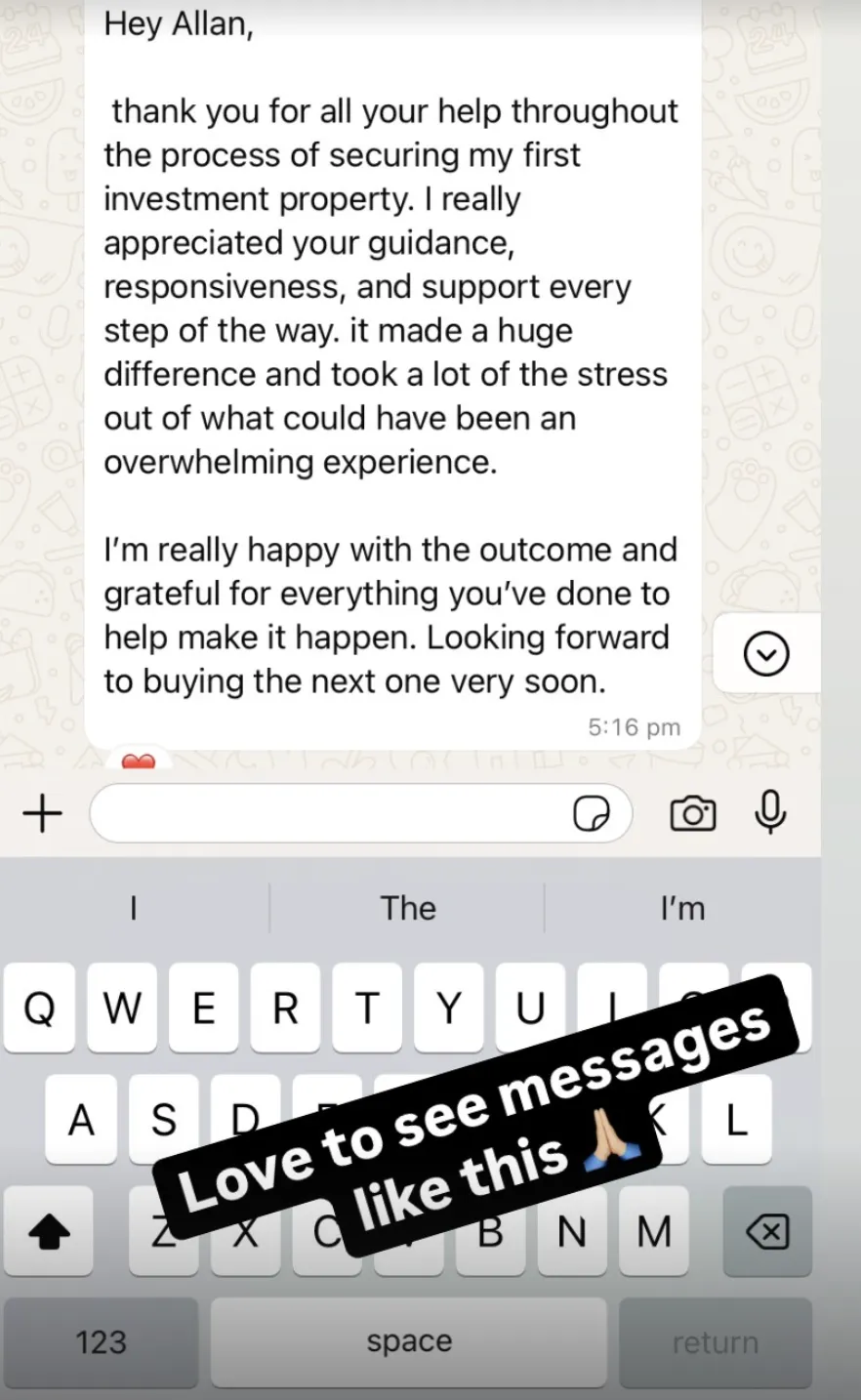

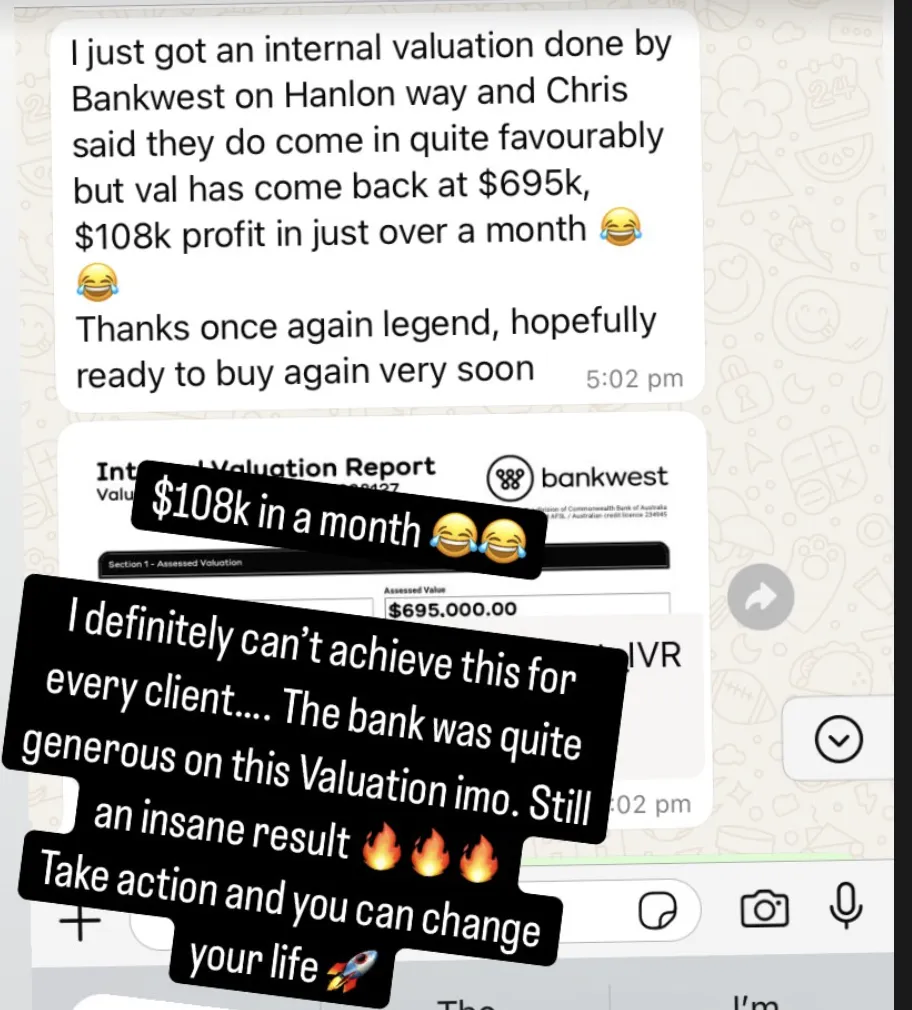

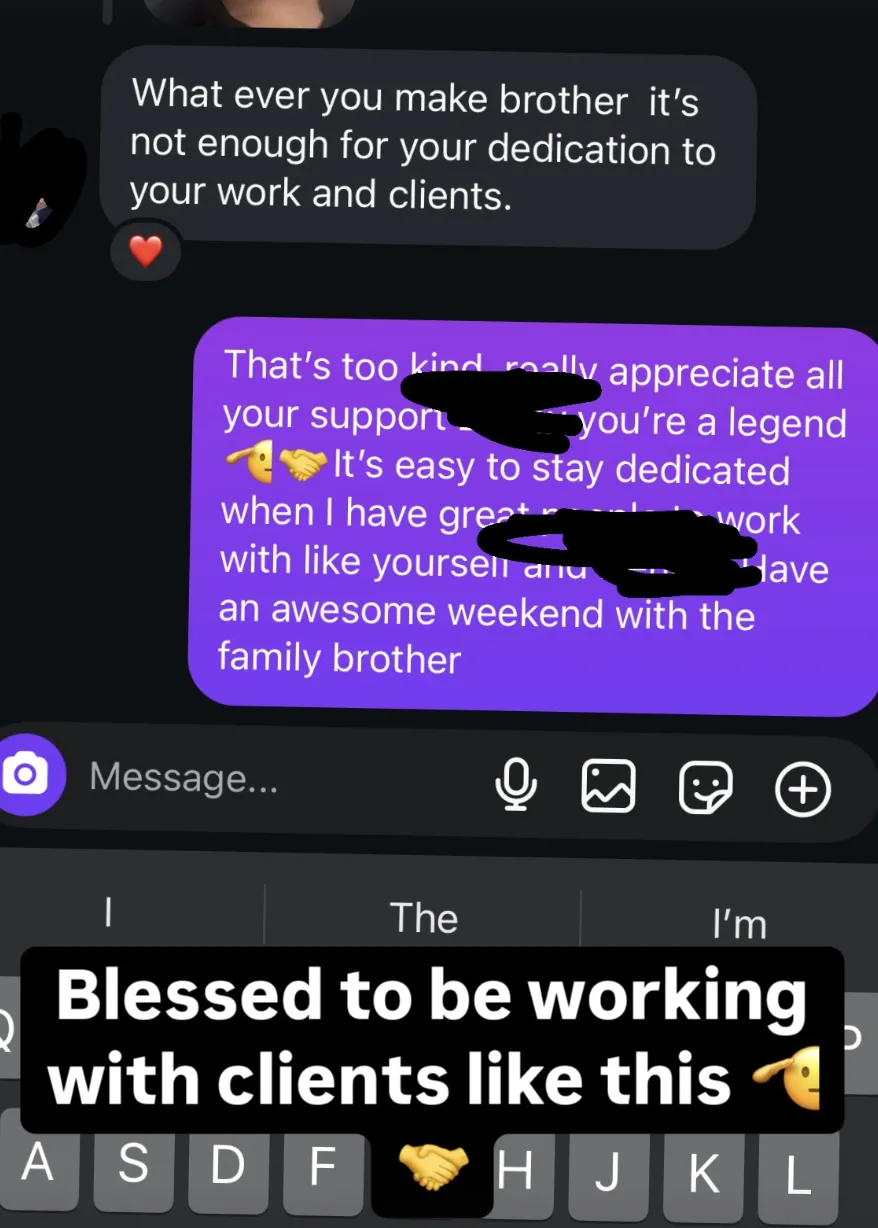

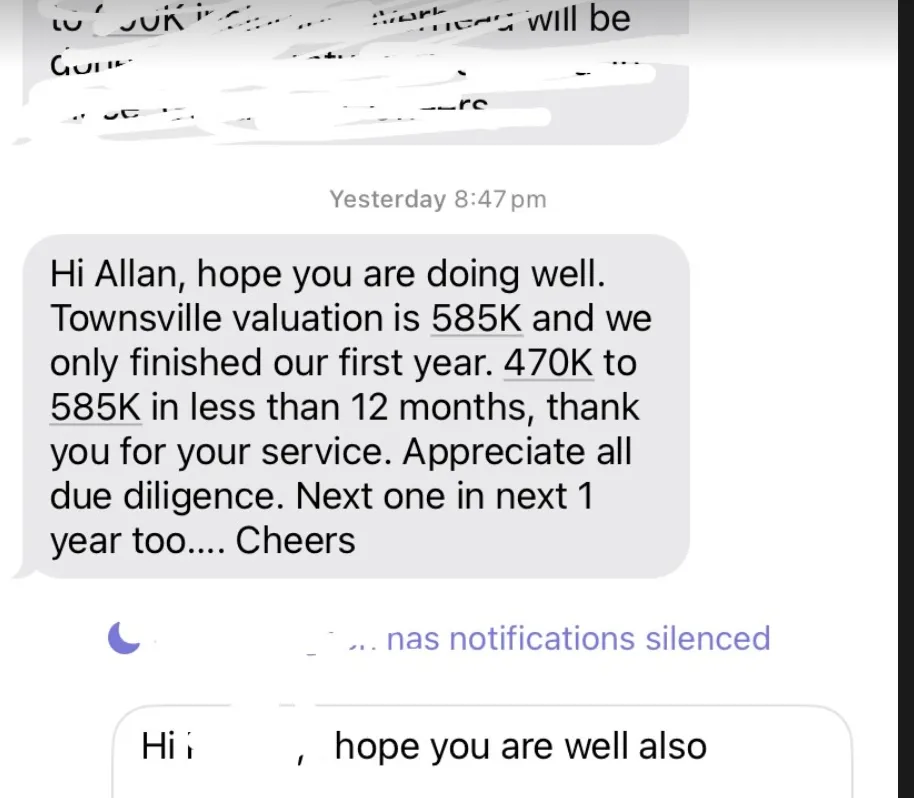

TESTIMONIALS

What others are saying

"It was a quick process but we didn't feel rushed" - Jon

"Your service was bespoke and tailored which was really good" - Patrick

"You delivered where it mattered most." - Godwin

"I couldn't recommend it enough and we're looking forward to our 2nd investment property." - Michael

"The accessability and professionalism was really good" - Vikas

"You won't be dissapointed." - Douglas

"You really cared for what you did. I can really attest to the value that I've received" - Benard

"Very methodical and clear with their approach" - Madhava

The results your previous buyer's agent or property guru wasn't able to deliver.

STILL NOT SURE?

Frequently Asked Questions

How does it work?

In short, you start by watching the free training. This shows you exactly how the Capital Growth Accelerator™ works and how we consistently target above-average capital growth.

If you want help applying it to your own situation, the next step is to book a discovery call. On that call, we look at your budget, goals, and timeline and determine whether we can genuinely help you. If we can’t, we’ll tell you upfront.

If it is a good fit, we then book a strategy session where we walk you through:

What’s included in the Capital Growth Accelerator™

Our guarantees

Our fee structure

If you decide to move forward, here’s what happens next.

You’re onboarded into your private WhatsApp group and private Skool community, where you get access to the same education and frameworks we use internally. We don’t believe in gatekeeping or keeping our process a mystery.

Most clients gain clarity almost immediately, because they finally understand:

Which suburbs actually make sense for their budget

What to avoid

Where the next growth cycles are forming

What an A-grade property truly looks like

From there, we handle everything for you.

We research suburbs, analyse and source properties, negotiate on your behalf, run due diligence, and guide you all the way to settlement. You’ll receive clear, structured updates whenever a suitable opportunity comes up so you never miss out.

After settlement, we continue to support you through leasing, property management, and future strategy, so you’re not left on your own once the purchase is complete.

In simple terms:

You learn the system in the free training

You book a call if you want help applying it

If it’s a good fit, we secure you an A-grade property using a proven system designed to outperform the market

Do you buy all across Australia?

Yes, we buy nationally, but not everywhere.

We only buy in markets that are early in the growth cycle and meet our A-grade criteria.

We spend a huge amount of time analysing data, tracking supply and demand, and visiting these markets so we know exactly where the next run of capital growth is coming from.

If a location doesn’t stack up, we simply won’t buy there.

Every property we secure must match your budget, your holding cost threshold, and your long-term strategy and it must have above-average growth potential based on real data, not hype.

If you want to know which markets make sense for your situation, book a call and we’ll map it out for you.

Who is Simple Capital Advisory?

Simple Capital Advisory is led by Allan Fernandes and a small, highly specialised acquisitions and client success team operating Australia-wide.

We focus exclusively on helping busy professionals secure A-grade properties with strong capital growth using a simple, data-driven system.

You’ll be supported by our experienced team throughout the entire process, from acquisition through to conveyancing, building and pest inspections, leasing, and property management.

We are intentionally boutique. We prioritise results over volume and work with a limited number of clients to ensure every purchase meets our strict A-grade criteria.

Our focus on quality over quantity is why Simple Capital Advisory has grown rapidly and why our clients consistently outperform the broader market.

If you’re looking for a done-for-you service that removes confusion, saves time, and helps you buy genuinely high-quality assets, that’s exactly what we do.

How much do your services cost?

Most buyer’s agents in Australia charge anywhere from $15,000 to $35,000, depending on the level of service, strategy, and complexity involved.

Our fees sit toward the lower end of that range, not because we cut corners, but because we’ve built a highly efficient, systemised process that focuses on outcomes rather than overhead.

What matters far more than the fee is the quality of the asset you end up owning. A poor purchase can cost you hundreds of thousands of dollars over the next decade. A strong one can materially change your financial position.

We focus exclusively on securing A-grade properties with strong capital growth fundamentals. Our clients don’t work with us because we’re the cheapest. They work with us because the value of the outcome significantly outweighs the fee.

The best way to understand whether we’re a good fit, and what the investment would look like for you, is to book a discovery call. If we can help, we’ll explain everything clearly. If we can’t, we’ll tell you upfront.

Can you recommend property managers, conveyancers, and building and pest inspectors?

Yes. We work with a national network of trusted, high-performing professionals across Australia, including property managers, conveyancers, building and pest inspectors, and trades.

These are operators we’ve personally vetted through repeated transactions and ongoing performance. They understand our standards and work seamlessly within our process.

This means you don’t need to waste time researching, comparing, or guessing who is reliable. We connect you with the right people at the right time so the process runs smoothly from offer through to settlement and leasing.

Once you come onboard, we coordinate and guide you through each step. If you already have preferred contacts, you’re welcome to use them, but most clients choose to leverage our network for speed and certainty.

Do you only work with investors?

We work with clients whose primary goal is maximising capital growth.

In most cases, that means investors, because they are focused on long-term performance and buying in early-stage growth markets.

We also work with a limited number of owner-occupiers who prioritise capital growth as part of their broader strategy. For owner-occupiers, our service is currently available in Melbourne only. For investors, we operate Australia-wide.

If your goal is to buy the right property at the right time and position yourself for strong long-term growth, we can explore whether our service is the right fit.

How do you ensure a property is a good investment?

We don’t rely on opinions, hot tips, or one-off success stories. Every decision is made using our Property Trading System™, a disciplined, data-driven framework designed to prioritise capital growth while actively reducing risk.

The process has four non-negotiable stages.

1. Strategy before property

Before we look at a single suburb or listing, we define your strategy. That includes your budget, risk tolerance, holding costs, and long-term objectives. If a property doesn’t align with your broader plan, we don’t pursue it, even if it looks attractive in isolation.

2. Market selection, not postcode guessing

We use objective market data to identify locations that are early in the growth cycle, constrained by supply, supported by rising demand, and underpinned by clear economic and demographic drivers.

We focus on markets where growth is driven by fundamentals, not speculation.

3. Asset quality and price discipline

Within those markets, we apply strict A-grade criteria to filter out inferior stock. We then assess fair value using comparable sales and local market dynamics to ensure you’re not overpaying or buying compromised assets.

4. Ruthless due diligence

Every shortlisted property goes through a full due diligence process. Legal review, building and pest inspections, rental assessment, and risk checks are all completed before proceeding. If red flags appear, we walk away. No sunk-cost bias. No emotional decisions.

This approach allows us to be selective, consistent, and disciplined. We don’t try to pick winners. We focus on avoiding bad decisions and putting the odds in your favour over the long term.

How long does it take to secure a property?

Most clients secure a property within 1 to 3 months. The exact timeframe depends on your budget, criteria, and the market we’re buying in.

In some cases, if the right opportunity presents itself early, this can happen much faster. In others, particularly where criteria are very specific or market conditions are tight, it may take longer.

Our focus is not speed for the sake of speed. We only present opportunities that meet our A-grade criteria and align with your strategy. If the right asset isn’t available, we wait.

That discipline is deliberate. Buying the wrong property quickly is far worse than buying the right property at the right time.

How much money do I need to invest?

It depends on your situation and how you’re structuring the purchase.

In some cases, such as where guarantor support is available, it may be possible to get started with relatively little upfront capital. However, this is not the norm.

As a general guide, most investors need around $80,000 to $100,000 in usable equity or cash to begin comfortably. This typically covers the deposit, purchase costs, and appropriate buffers.

If you’re targeting a more blue-chip asset or higher price point, you may need closer to $150,000 to $200,000, depending on the strategy and location.

If you’re unsure where you sit or what your borrowing capacity looks like, we can point you in the right direction to get clarity before taking the next step.

MEET THE FOUNDER & CEO

Allan Fernandes

I help busy professionals buy A-grade properties that grow faster than the number of people Googling "best areas to invest".

When we work together, your goals become my mission.

I have helped hundreds of investors across Australia secure high-growth properties using a simple system that has outperformed the national average every single time.

If you want serious capital growth, I can help you get it.

Runs one of Australia's fastest growing buyer's agencies

Every single purchase has outperformed the national growth average in the first year

Known for finding A-grade deals faster than you can say capital growth

Official record holder for most people rescued from Facebook property groups

Responsible for reducing the number of people Googling "best areas to invest"

© 2026 Simple Capital Advisory - All Rights Reserved.